Grosvenor Heights | Westside at Shady Grove Metro | Montgomery Row | The Brownstones at Chevy Chase Lake | Robinson Landing | Home Buying Tips | interest rates

By: EYA Homes on February 23rd, 2018

Mortgage interest rates have climbed steadily since the first of the year.

According to BankRate, the Fixed National Average for a 30-year loan has increased from 3.85 percent on January 1st, to 4.35 percent on February 21st, half a percentage point increase. Rates were last above 5 percent in 2011.

To better understand these changes, we sat down with Joshua Jablonski of Wells Fargo Home Mortgage to gain his insight on what homebuyers and sellers can anticipate in the coming year. Josh has been lending to buyers in the DMV for the past 16 years.

What is your overall message to homebuyers right now?

Seize the day while interest rates are low. Everyone agrees that higher interest rates are coming but too often most don’t have the urgency to act until it’s too late. We’ve all been guilty of that because we’ve seen so much stability over the last several years. Whether you need 2, 12, or 24 months—secure long-term pricing now while your new construction home is being built and you’ll be protected from future interest rate increases.

Why did we have so much stability?

Interest rates were kept low—artificially—by government intervention through a program called quantitative easing. When the economy was down, the Federal Reserve was purchasing as much as $85 billion a month in treasury bonds and mortgage-backed securities (over $3 trillion in six years). As the bond buying ended in late fall 2014, people expected rates to go higher in 2015 and 2016. But this was also a period when there was a lot of instability in the world with events like Brexit. So even as the Fed purchasing program slowed, we saw a lot of momentum for keeping rates low from foreign investment in the U.S. markets.

What changed causing interest rates to increase?

The U.S. economy improved and many world economies began to stabilize as well. We no longer have the world economic instability and the benefit of six plus years of government intervention, which kept interest rates low.

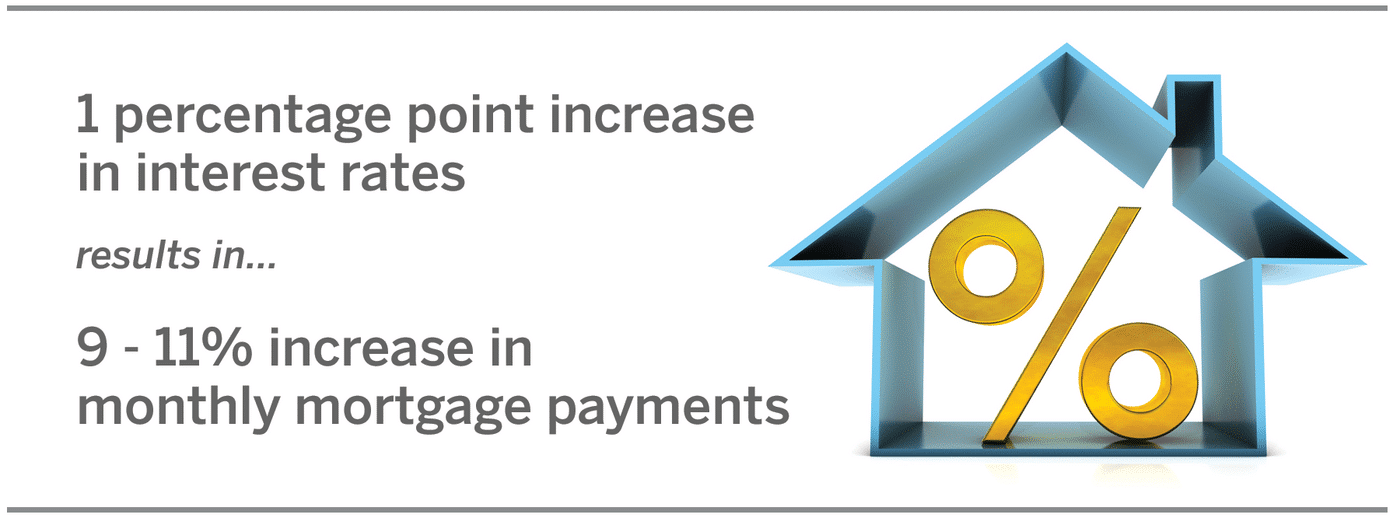

Based on forecasts, it’s not unreasonable to expect an additional percentage point increase in mortgage rates this year. To what degree will monthly mortgage payments jump as a result?

Higher interest rates cut into the purchase price in a lot of different ways. When we see a one percentage point increase in mortgage rates, the scale moves between a nine and 11 percent hike in mortgage payments (depending how much you put down and the size of your residence). But the hidden costs for waiting are the effect on consumer behavior. You may have to buy a smaller home or consider a completely different location. A percentage point increase could be the difference of an extra bedroom or a totally different zip code.

Are there implications for sellers?

There are a lot of things that have happened beyond just affordability. For instance, as rates go up, there are increasing loan qualification issues for everyone. In particular, the entry level or first-time homebuyer is most often going to be negatively impacted by their debt-to-income ratios moving higher as rates rise. Not only is the mortgage payment rising, home equity loan payments, credit cards, student loans—all of it can go up. If you are a move-up or downsizing homeowner purchasing a new construction home, listing your current home early in the construction process and selling now may mean you can sell for more money to a larger pool of qualified buyers before rates increase.

In summary, if you are planning to move this year, waiting could cost you. Your current home could be less affordable for many buyers than it is today, and the home you want to buy may cost you more.

Ready to find your new home and lock in your interest rate? Visit EYA.com to view our actively selling Montgomery County and Alexandria neighborhoods.

January 15, 2020

We are honored to announce that EYA neighborhoods have once again been voted 'Best of' in Bethesda Magazine's 2020 readers' poll. We were thrilled to see that The Brownstones at Chevy Chase Lake were awarded the Readers' Pick for Best New Townhome Community, with both Grosvenor Heights and Montgomery Row ranking in the top 5. The Lindley was also voted in the top 3 for the New Luxury Apartments category.

October 11, 2019

From dog parks and local trails to dog dining and diving, we've compiled a list of the best local spots to enjoy some time with your favorite furry friend in and around Bethesda, MD! Here are the top places to explore, eat, and enjoy with your dog:

September 26, 2019

As one of the most renowned communities in the DC metro area, Bethesda, MD is known for its eclectic mix of restaurants, extensive boutique and retail shopping, vibrant downtown, and variety of fun outdoor activities. Not only does Bethesda have so much to offer in terms of entertainment, but it offers its residents close proximity to the nation's capital as well as a variety of transportation options.

September 12, 2019

Do you ever get stumped with the, ‘where should we go for dinner’ debate? Pulling out your phone, you google ‘best restaurants in Rockville' with the hope of finding somewhere new to try. After scrolling through an overwhelming list of choices and Yelp reviews, you finally decide to just head out to your favorite go-to spot.