Should I Move? Considerations for an Empty Nester

Bethesda | Grosvenor Heights | Westside at Shady Grove Metro | Montgomery Row | Lock and Go Lifestyle | Chevy Chase Lake | The Brownstones at Chevy Chase Lake | New Townhomes | Robinson Landing | walkable community | D.C. Area

By: EYA Homes on June 10th, 2019

Should I move? It's the question nearly every empty nester considers. You might be evaluating the benefits of staying in your longtime home or thinking about making a move to a new home more suited to your current lifestyle.

Either way, you're not alone! For many Boomers, older (and often larger) homes no longer suit their needs and moving to a new residence is appealing.

New home options such as condominiums and elevator townhomes that offer open floor plans, new appliances, healthier/chemical-free building materials and energy efficient designs are extremely attractive. Not to mention the added benefit of a low maintenance, lock and leave lifestyle works well for frequent travelers or those with second homes.

This can be a difficult decision, so here are a 3 things to consider while you are in the decision making process:

1. Is It the Right Time to Sell?

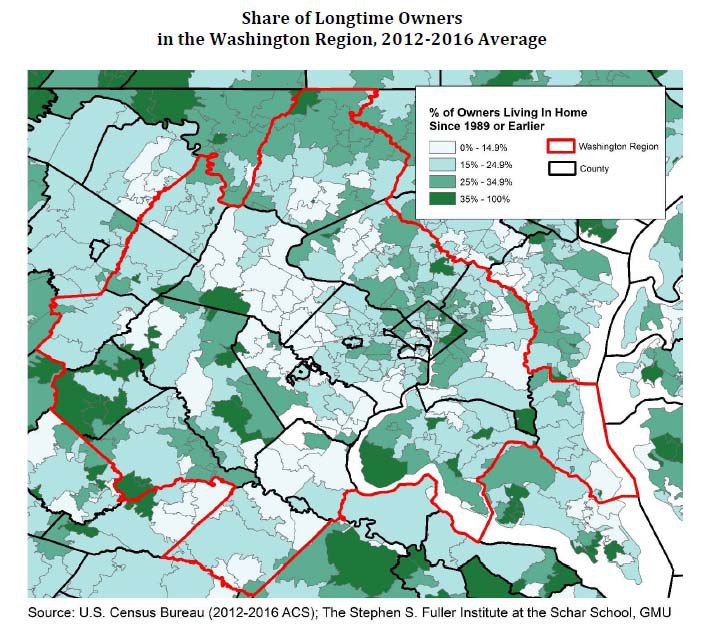

Baby boomers and older adults are a dominant force among the region’s homeowners, especially in established Montgomery County neighborhoods close to the Beltway.

According to a study conducted by the Stephen S. Fuller Institute at George Mason University, some of the highest concentrations of local residents who have lived in homes since 1989 – 25 to 34.9 percent – exist in communities like Bethesda, Chevy Chase, Kensington, Potomac and Rockville.

While this study was conducted in the summer of 2018, the economic trends as of summer 2019 remain the same, reinforcing the area’s home buying market. So selling sooner rather than later, should ultimately still result in a higher sales price.

Adjoining neighborhoods just inside the District line – Chevy Chase, Friendship Heights and Tenleytown – share similar numbers.

The study concludes that as residents age and move out, the communities with longtime owners will face the greatest home value volatility; making a case for why it makes sense to sell now.

If only 20 to 30 percent of the D.C. region’s Baby Boomers decide to sell in the upcoming years, it may result in 100,00 to 150,000 new homes on the market, according to the Fuller Institute. By comparison, 85,720 homes went on the market in 2017.

This potential for high turnover will result in a larger inventory of homes available for purchase and more competition among sellers. Millennial buyers facing rising interest rates and high levels of student debt are likely to focus on the best price available.

So selling sooner rather than later, should ultimately result in a higher sales price.

2. How Can Moving Impact My Lifestyle?

A new home offers the opportunity to modernize your lifestyle with open floor plans and modern amenities. Most buyers want brand new kitchens that open into living spaces and airy main levels not found in older homes. Bonus features can include separate living space for parents or visitors and private elevators. Plus, many new homes offer increased energy efficiency and improved indoor air quality.

Older single family homes may be well-loved but they often require significant upkeep and repair costs, maintenance and yard work. If you are ready to simplify your lifestyle, a new condo or townhome may offer lifestyle benefits such as less home maintenance and more time to do what you love.

Plus , many new homes in the DC metro area are situated in close-in, walkable communities. This means they offer the added benefit of an accessible location with nearby stores, restaurants and other community amenities. They also provide easy access to public transit that may include some combination of Metro, Metro Bus, commuter rail, walking trails and bike paths, or even the Purple Line light rail being developed in Montgomery County.

Some of the important benefits to these walkable communities are:

Increased Physical Activity

Walkable and bikeable communities allow empty nesters to increase their level of exercise, remain physically active and improve their health.

This is so important, that even the CDC and the Surgeon General in cooperation with the U.S. Department of Health and Human Services have devoted resources to helping communities design and promote walkability as a way of improving public health.

More Social Interaction

Neighborhoods built with walkability in mind help to foster a sense of community. Because residents see each other on the sidewalks and out at local stores and restaurants, there’s more engagement among neighbors and with area businesses. This strengthens bonds and builds trust in the community.

Support for Small Business

When local stores and restaurants are within walking and biking distance, community residents tend to patronize those businesses versus getting in their car and going elsewhere. Proprietors get to know their regular customers on a personal level, which reinforces loyalty and ultimately helps to create vibrant business districts that can grow and expand services for the community.

3. What Will Not Moving Cost Me?

As empty-nester homeowners evaluate moving options, the financial cost of “staying put” should be an important consideration in the decision-making process. Recognizing and accounting for needed exterior home maintenance expenses and the replacement costs of major household systems and appliances is key. Some folks don't mind the effort to deal with repairs and renovation, but even they need to assess hard costs for common repairs needed for older homes:

Roofing

Homes built in the 1970s with slate, copper or clay/concrete roofs are approaching their 50-year life expectancy according to CNN Money’s useful guide “How Long Things Last”. Roofs with wood shakes go about 30 years while shingled roofs last approximately 25 years. While prices for roof replacement will vary, on average a 2,000 sq ft single family ranch home roof replacement could cost between $8,500 - $16,500+ depending on factors such as location of home, roof complexity and type of shingles installed.

HVAC Systems

Components of an HVAC system should last 15 to 25 years in a best-case scenario according to CNN Money. The life expectancy for system components – furnaces, air conditioners and heat pumps – that are not serviced annually could be much less. Replacement costs are substantial and whether your home has a one or two-zone system makes a difference.

Hot Water Heaters

Water heaters are one of the most common home components requiring replacement. A 50-gallon tank can be expected to last eight to 12 years according to Angie’s List and costs for a new tank range from $765 to $2,800, excluding plumber installation fees. Tankless systems run less - $500 to $1,800 – but installation can be complicated and exceed a couple thousand dollars for a first-time installation.

Appliances

When it comes to appliances, CNN Money is a good source to determine when you should expect things to give out. Home gas ranges have the longest life expectancy (15 years), followed by washer/dryers and refrigerators (13 years), dishwashers and microwave ovens (9 years) and compactors (6 years).

Lawn Care

A variety of factors enter into the equation for lawn maintenance costs: including weekly service charges, larger maintenance and gardening projects, and seasonal treatments.

For many homeowners, their large family homes come with expansive yards that require a lot of care, even when or especially when you are away for extended periods.

Be it summer yard work, fall leaf blowing and pick up, and winter snow removal, it all adds up and your annual total for lawn maintenance alone is likely to fall into the $2,000 to $5,000 range depending on lot size. Additional services required to keep your home looking great – especially for landscaping and tree work – could double the cost.

The Bottom Line

Deciding when it’s time to move is a personal decision with many factors to consider. These include lifestyle choices, the housing market, and knowing the real costs of staying or moving. Speaking with a real estate professional, financial planner, and trusted family and friends can help you make the decision that's right for you.

If you need a little guidance on which EYA community is right for you, take the quiz!